how to pay hmrc tax

I have been looking into getting a prepaid credit andI was hoping to use my Amex as a form of top up method - cashplus is not available in my local post-offices and Ramsdens Cheque Centre and Money Shop dont accept Amex as a form of payment With. If you do not have a bill or youre not sure HMRC recommends using HMRC Cumbernauld.

.png) |

| How Do I Increase Decrease My Payments On Account Towards The Following Tax Year Knowledge Base |

HMRC Cumbernauld - Account number.

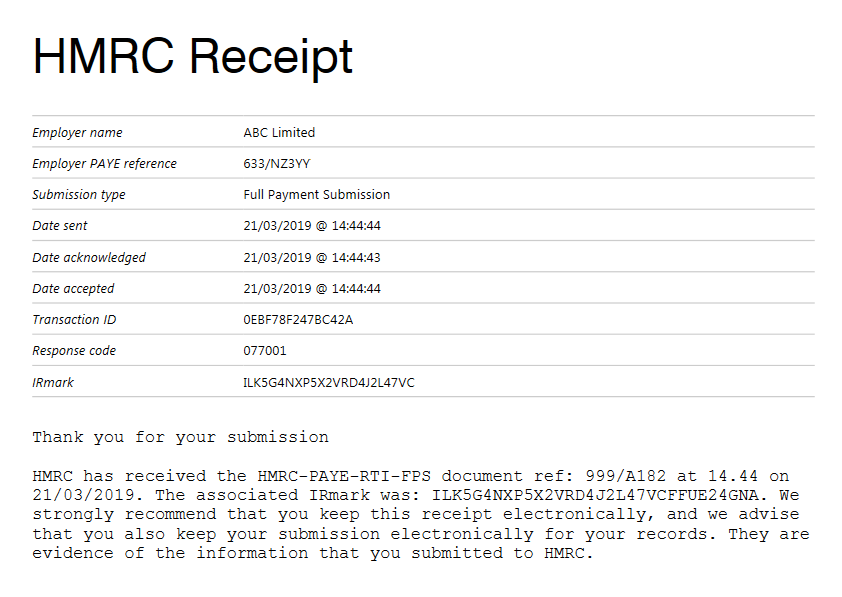

. 12001039 Sort Code. You can pay PAYE by Direct Debit BACS CHAPS by online or telephone banking by online card payment at your bank or building society or by cheque. I am wanting to pay my tax bill using Amex but HMRC do not accept that as a form of payment. HMRC Her Majestys Revenue and Customs use their tax calendar to break payroll dates into tax weeksmonths.

You can use GOVUK Pay to take credit and debit card payments by telephone or post. Your personal allowance is the amount of money you can make in a year before HMRC taxes you. Tell HMRC about a new employee. The deadline to pay HMRC self assessment tax liabilities will usually be the 31 January following the end of the tax year in question.

HMRC Shipley - Account number. HMRC has two different accounts that your tax can be paid into. But before you choose this option you need to factor duration time as. These are sometimes called MOTO payments.

You get all of the advantages and security of using GOVUK Pay but you fill in your users details on the payment. The 22nd of the next tax month if you pay monthly. Bank details for electronic payments. If youre self-employed HMRC may ask you to pay an estimated amount of tax in advance which is known as payments on account.

12001020 Sort Code. When the employee actually gets their pay. Get their personal details. Think of us as your credit card in disguise.

Direct Debit if youve set one up with HMRC before By cheque through the post. Its the end of the month or the quarter. If youre calling from abroad call 44 135 535 9022. You pay your HMRC bill with a Curve debit card but its your credit card underneath that funds the transaction.

Direct Debit if you havent set one up with HMRC before Please refer to the. The 22nd after the end of the quarter if you pay quarterly - for. Create a hosted payment page or integrate your existing service. If they discover that youve paid too much income tax you get a tax refund and its usually paid back to you in your next wage packet.

The tax weekmonth is always based on the pay date for the period eg. You must tell HMRC about your new employee on or before their first pay day. If you cant communicate by phone you can use. If you prefer to pay through your bank or building society first you need to order paying by phone or paying in-slips online.

Option 2 Contact HMRC online or by telephone for tax refund. Step5Tell HMRC about your new employeeShowthis section. This involves making two payments - one. Yes HMRC actually prefers queries on the phone.

This means that for a tax liability that. Tax Months always start on the 6th and run to the following. Other things like work expenses and. If you think you have paid the wrong amount of tax you can also contact the HMRC directly to claim a tax refund online via.

You must pay your PAYE bill to HM Revenue and Customs HMRC by. This calendar is fixed and does not change year on year. Suddenly its time to pay PAYE tax to HMRC. Accountants are in a race against time to ensure their SME clients arent penalised for late.

Your bill will tell you which account to pay in to. In the 2020-2021 tax year your annual personal allowance is 12500. If you want to take online payments and dont have an online service create a GOVUK payment page. The income tax inquiries number is 0300 200 3300 if youre calling from inside the UK.

|

| How To Pay Hmrc Self Assessment Income Tax Bill In The Uk |

|

| What Is A Utr Number What To Do If I Have Lost My Utr Number Dns Accountants |

|

| It Might Still Pay To Declare Your Tax By 31 January Investors Chronicle |

|

| What Happens If I Do Not Pay Enough Tax Low Incomes Tax Reform Group |

|

| Hmrc Suspends Some Tax Investigations Due To Pandemic Financial Times |

Posting Komentar untuk "how to pay hmrc tax"